Open Enrollment Extends through December 7, 2023

It’s open enrollment time for Medicare Part D, which provides prescription drug coverage for people age 65+. While you can enroll in a plan at any time, this is the annual window during which you can change your plan. Below, we answer some of the frequently asked questions about Medicare Part D we get from our patients.

What Are Medicare Part D Plans?

Medicare Part D is the prescription benefit portion of the Medicare coverage you become eligible for at age 65. It’s offered through private companies either as a stand-alone plan (if you are enrolled in original Medicare) or as a set of benefits included with your Medicare Advantage Plan. In most types of Medicare Advantage Plans, you can’t join a separate Medicare prescription drug plan.

Each plan covers a variety of brand-name and generic prescription medications. You can review each plan’s list (called a formulary) of drugs with varying costs depending on the plan you choose. Typically, the drugs are divided into groups (called tiers) based on cost, with medications in a lower tier costing less than those in higher tiers.

When choosing a Medicare Part D plan, you’ll want to consider more than just the price of the medications you are currently taking. Most plans have an annual premium, yearly deductible, and copayments/coinsurance.

When Should I Enroll in Medicare Part D?

Medicare recommends enrolling in a Part D plan as soon as you are eligible—even if you do not currently take prescription medications—to avoid late enrollment penalties.

It’s important to know that the late enrollment penalty is not a one-time fee; it increases the longer you wait to join a Part D plan and lasts as long as you have the coverage, even if you switch plans. You’ll pay an extra 1% for each month that you could have joined a plan and didn’t.

What Is the Medicare Donut Hole?

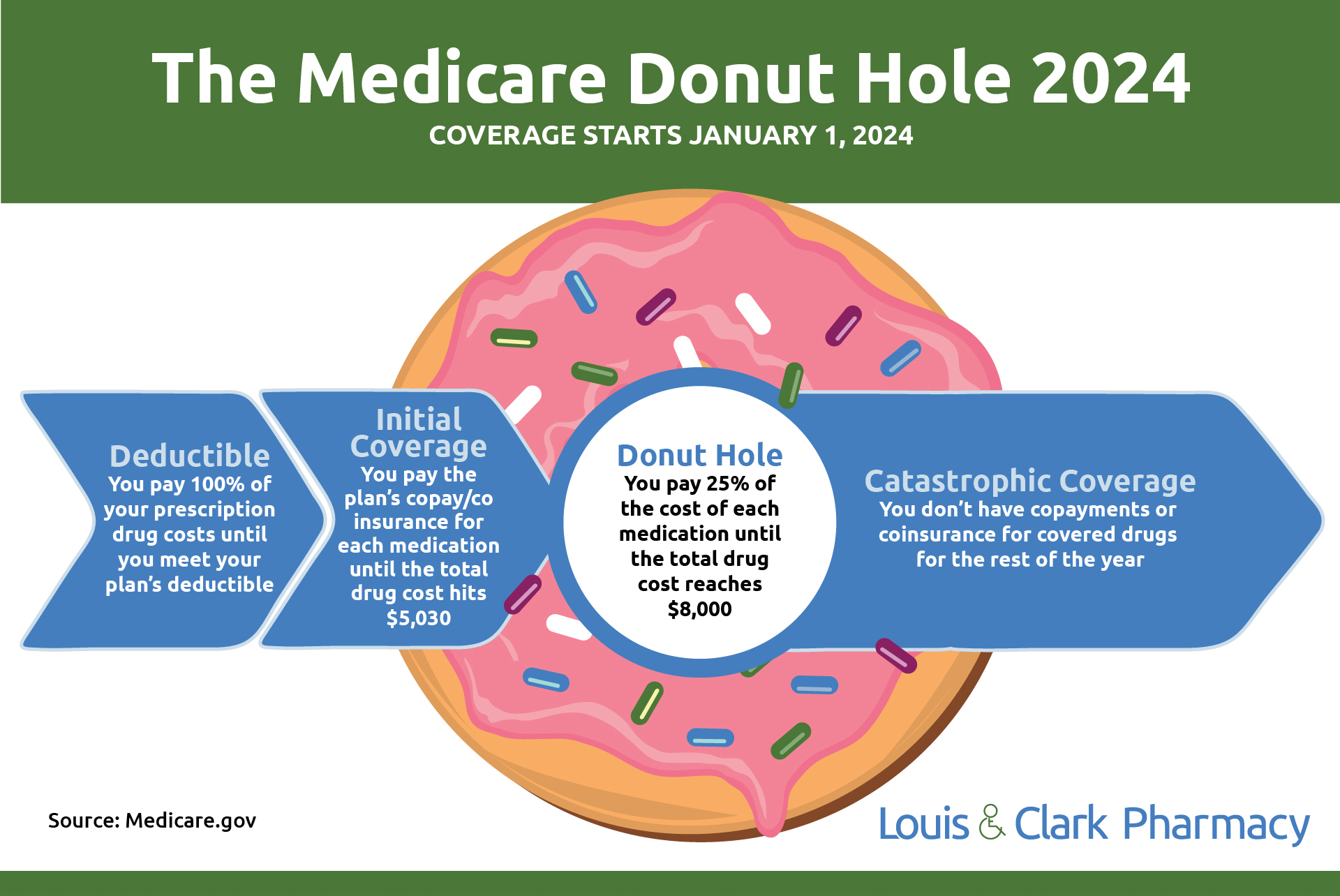

The coverage gap, known as the Medicare Donut Hole, places a temporary limit on what the plan covers for drug costs when you reach a certain threshold, which changes every year. This is what it looks like for 2024:

Not everyone enters the coverage gap, because not everyone reaches the annual prescription cost threshold ($5,030 in 2024). Also, if you have Medicare and get “Extra Help” paying part D costs, it won’t apply to you.

What Is “Extra Help” For Medicare Part D?

Extra Help is a Medicare program for people with limited income and resources to pay their Medicare Part D premiums, deductibles, copays/coinsurance, coverage gaps and other costs.

Based on your income, you may also qualify for Prescription Drug Assistance through the state of Massachusetts, which provides financial help to lower prescription drug costs.

How Do I Choose the Medicare Part D Plan That’s Right for Me?

We know choosing the Medicare Part D Plan that will work best for you can be complicated. Fortunately, we have several great resources in our area to help you assess your options:

- The SHINE Program, administered by the Massachusetts Executive Office of Elders Affairs, provides free, unbiased health insurance counseling. You can reach a local, certified Medicare Counselor by calling 1-800-243-4636.

- WestMass Eldercare provides a range of programs and services, including free health insurance counseling: 413-538-9020.

- Highland Valley Elder Services offers a benefits support program with certified application counselors: 413-586-2000.

Here to Help

There are other ways to save on prescription drug costs, such as switching from brand-name to generic medications. Our pharmacists are available to answer your medication questions and work with your doctor to discuss possible options.